Choosing the right broker can significantly impact your financial health, client relationships, and the overall success of your practice sale. Before scheduling a second call, it’s critical to ask targeted vet broker checklist questions that uncover how well the broker understands your practice’s operations, financial records, and legal considerations.

This five-question checklist helps you assess their experience with practice valuation, purchase agreements, and client demographics—ensuring they can support a smooth transition, protect client service standards, and position your business for future growth.

Can You Provide a Clear, Line-Item Breakdown of All Fees?

Understanding how much a broker charges—and for what—is one of the most important steps in the buying process. A clear breakdown of costs helps you plan effectively and avoid financial surprises during the sale process.

Importance of Fee Transparency

Knowing all fees in advance protects practice owners from last-minute surprises that could significantly impact their cash flow or purchase price. Transparency also supports better financial management throughout the due diligence process. Brokers who clearly outline payment terms, seller financing options, and marketing costs give you the clarity needed to protect client satisfaction and maintain control of your practice’s operations.

Typical Fee Structures

Different brokers use different pricing models. Asking for a detailed, written explanation ensures you can compare your options and avoid vague language that may hide additional charges.

- Commission-Based Fees: Often structured as a percentage of the final purchase price, though the rate can vary based on business type and broker policies.

- Retainer Fees: Upfront charges that cover basic service costs, even if the sale doesn’t close.

- Marketing Fees: Flat-rate or itemized charges for listing your practice, promoting to prospective buyers, and producing sales materials.

- Administrative or Legal Fees: Additional costs tied to preparing confidentiality agreements, lease agreements, or legal documents.

Can You Cite Three Recent Deals You’ve Closed in My Industry?

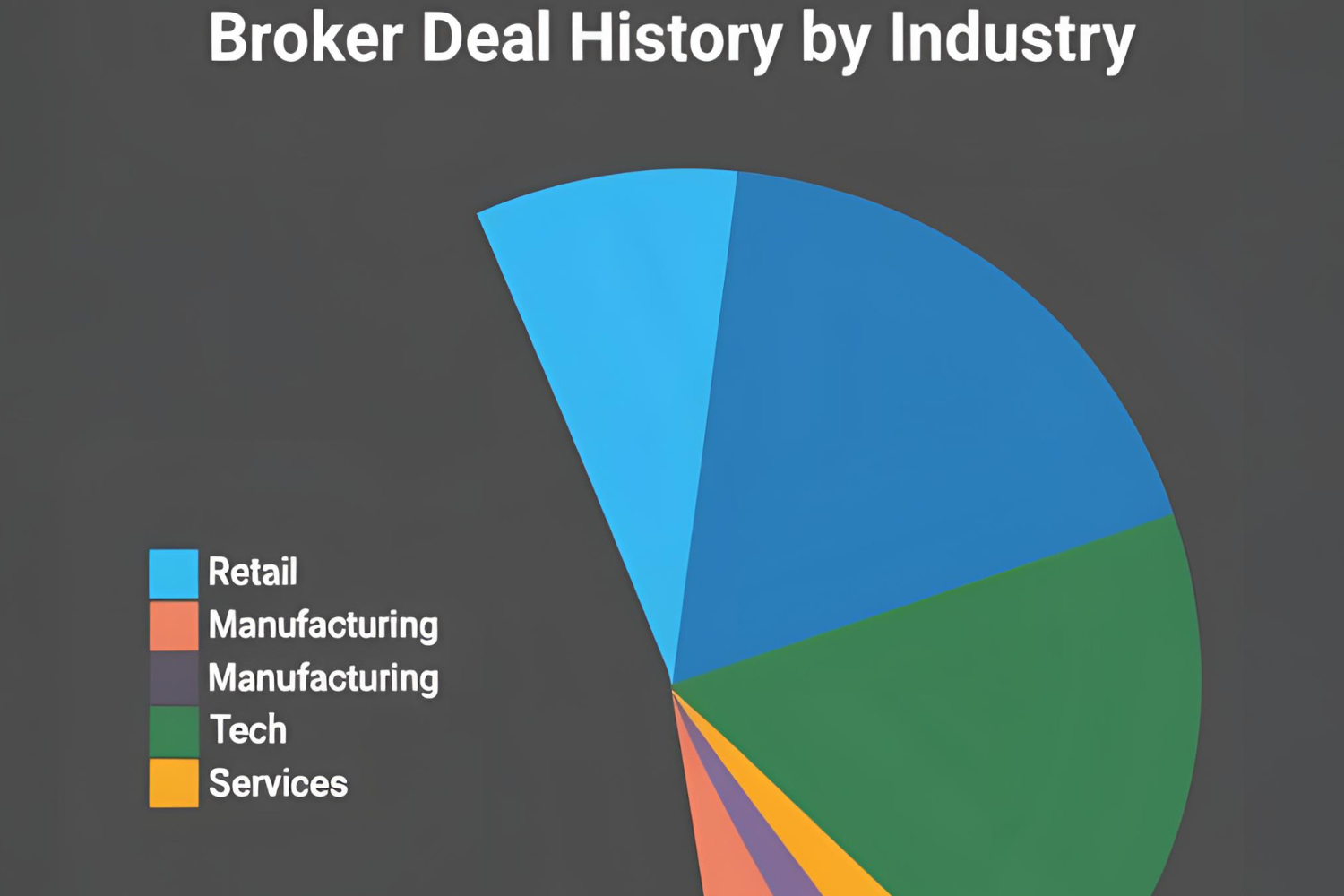

Asking for relevant deal experience helps you understand if a broker can meet your expectations. Their past work reflects how well they understand your niche, including practices like emergency clinics or specialty vet services.

Assessing Relevant Experience

A broker who has recently sold practices similar to yours—such as an existing clinic with multiple vets or a new practice offering preventative care—shows they understand the complexities of sales. This includes handling intangible assets like intellectual property, client communication systems, and staff training processes. Brokers with experience in practice ownership, real estate transitions, and managing electronic medical records can better support your goals.

Evaluating Deal Metrics

Deal metrics provide a snapshot of how well the broker performed. Ask for sale prices, timelines, and practice types. This information helps you evaluate financial performance and see if they can deliver smooth transitions, handle tax implications, and protect client retention. Brokers with experience closing deals in your price range may be more familiar with attracting qualified buyers and negotiating favorable purchase agreements.

Can You Share at Least Two Client References I Can Contact?

References help confirm what a broker claims about their track record. Talking to former clients can help you spot issues early and avoid costly mistakes in the buying process.

Verifying Credibility

Hearing directly from past clients offers honest insights into how the broker handled real deals. It can reveal how well they supported the due diligence process, managed legal considerations, and helped practice owners navigate key issues like tax liabilities, lease agreements, or staff development. Strong references may indicate the broker’s experience handling complex situations and supporting client service during the transition.

Questions to Ask References

The right questions uncover how a broker handles challenges in real situations. Ask how the broker maintained confidentiality agreements, supported client communication, and kept the deal on track.

You can also check how the broker addressed financial records, employment contracts, and real estate issues. Learn if the client felt supported in preserving patient care, client retention, and the practice’s future growth.

Will You Provide a Written Engagement Outline or Draft Contract Before I Commit?

A draft contract shows how the broker plans to work with you. Reviewing it early helps you spot potential risks or misalignments before signing anything.

Understanding the Agreement

A clear engagement outline defines what the broker will and won’t do during the transaction. It covers legal documents, payment terms, and transition period expectations—so you aren’t left guessing. This step is especially important for practice owners managing large assets, such as intellectual property or inventory management systems. Getting these terms in writing helps avoid surprises and ensures compliance with the deal terms.

Key Elements to Look For

Look for these essential parts in any engagement outline or draft contract:

- Fee Schedule: Exact breakdown of commissions, retainers, and marketing charges.

- Marketing Strategy: How the broker will promote your practice to potential buyers.

- Timeline: Projected steps and timeframes for vetting private buyers or corporate groups.

- Termination Clauses: Conditions under which the agreement can be ended.

- Services Provided: Details on how they’ll handle things like legal documents, financial statements, and staff training coordination.

Do You Typically Respond to Initial Inquiries Within 24 Hours?

Responsiveness shows how organized and committed a broker is. It also sets the tone for how they’ll manage future updates during the selling process.

Importance of Prompt Communication

Quick responses signal that a broker takes your business seriously. Brokers who respond within a day are more likely to handle urgent matters efficiently—such as managing practice valuation questions, protecting client demographics, or addressing concerns about financial performance. Fast communication also supports smoother coordination of site visits, legal reviews, and negotiations with prospective buyers.

Setting Communication Expectations

Ask how often you’ll receive updates and what communication tools they use—email, phone, or text. Aligning communication styles helps prevent delays in sharing documents like financial statements or employment contracts. It also improves workflow when discussing critical steps such as negotiating terms, preparing for the transition period, or confirming support for new services that affect growth potential.

Ensuring a Successful Broker Partnership

Choosing the right broker starts with asking the right vet broker checklist questions. These five key inquiries help you gauge a broker’s ability to manage the buying process, navigate legal considerations, and support your practice’s operations.

A well-informed decision improves your chances of protecting financial stability, safeguards intangible assets like client communication systems, and increases the chances of a smooth transition. With the right broker, you position your vet practice for strong client satisfaction, future growth, and achieving a smooth transaction.

Frequently Asked Questions

What are the most important questions to ask a business broker before hiring them?

Key questions include inquiries about fee structures, industry experience, client references, engagement outlines, and communication practices.

Why is it important to get a written engagement outline from a broker?

A written outline ensures clarity on services provided, fees, and expectations, reducing potential misunderstandings.

How can I verify a broker’s experience in my industry?

Request details of recent deals they’ve closed in your industry, including sale prices and timelines.

What should I ask when speaking to a broker’s past clients?

Inquire about their overall experience, the broker’s communication, transparency, and the success of the sale process.

How quickly should a professional business broker respond to inquiries?

A prompt response, typically within 24 hours, indicates professionalism and a commitment to client service.

References

- Corporate Finance Institute. (2025). Seller Financing – Overview, How It Works, Advantages. https://corporatefinanceinstitute.com/resources/commercial-lending/seller-financing/

- Internal Revenue Service. (2025). Publication 544 (2024), Sales and Other Dispositions of Assets. https://www.irs.gov/publications/p544

- U.S. Department of Health & Human Services. (n.d.). Summary of the HIPAA Privacy Rule. https://www.hhs.gov/hipaa/for-professionals/privacy/laws-regulations/index.html

- U.S. Patent and Trademark Office. (2021). Trademark, patent, or copyright. https://www.uspto.gov/trademarks/basics/trademark-patent-copyright

- U.S. Small Business Administration. (2025). Close or sell your business. https://www.sba.gov/business-guide/manage-your-business/close-or-sell-your-business