If you plan to sell your company, learning business valuation small business basics gives you a clearer view of the value of your business and what buyers may be willing to pay. A solid valuation looks at cash flow, assets, intangible assets, and industry trends to create a realistic number you can use for planning.

This guide explains how small business valuation works, the main business valuation methods, and the communication habits that keep you aligned with your broker and valuation expert as you move toward a sale.

What Is Business Valuation For A Small Business?

A business valuation for a small business is the process of estimating a company’s worth. Value is based on cash flow, assets, liabilities, risk, and how easily a new owner can take over.

It gives business owners a realistic number grounded in financial performance and market conditions, not personal effort or assumptions. A proper valuation helps set expectations, supports major decisions, and prepares you for negotiations with buyers, lenders, or partners.

A Simple Definition (Without The Jargon)

A business valuation provides a clear estimate of what your company is worth based on earnings, assets, risks, and how easily the business can operate without you. It gives owners a grounded view that reflects real market factors rather than personal feelings or assumptions.

Buyers focus on stability, transferability, and the returns they can expect, so the valuation centers on what the next owner can realistically gain. This helps set fair expectations and supports smarter planning before entering the market.

How Small Business Valuation Really Works

Small business valuation works by reviewing your financial records, adjusting owner-related expenses, and analyzing assets, liabilities, and risk to estimate what buyers are likely to pay. Valuers also compare your company with similar businesses and assess true earning power through Seller’s Discretionary Earnings (SDE) or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

They then evaluate how easily the business can transfer to a new owner, since transferability affects buyer confidence and deal value. Because valuation blends numbers with professional judgment, experts usually present a value range rather than a single fixed number.

Key Inputs Valuers Look At

Valuers look at the financial strength, assets, and risks that influence what a buyer would realistically pay. They typically review:

- Financial statements from the past 3–5 years, including P&Ls, balance sheets, and cash flow.

- Owner adjustments to calculate SDE or EBITDA by normalizing salary, perks, and discretionary expenses.

- Assets and liabilities, such as equipment, inventory, property, brand value, contracts, intellectual property, and customer relationships.

- Risk factors include customer concentration, key-person dependence, system strength, and industry trends.

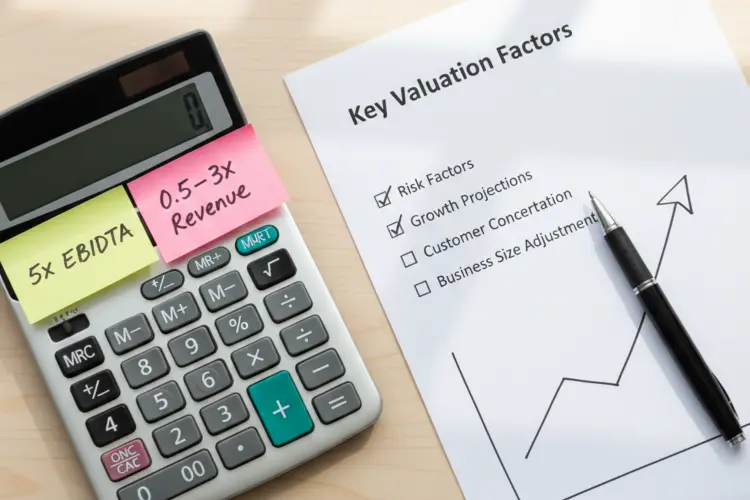

Key Small Business Valuation Methods

Small business owners use a few main valuation methods to figure out what their company might be worth. Each one looks at value differently; some focus on earnings, others on market comparisons, and others on assets. No single method works for every situation, so most valuers run several approaches side-by-side and use the results to build a realistic value range.

Income-Based Methods (Cash Flow and Earnings)

Income-based methods determine value by measuring how much income the business produces and how reliable that income is. These approaches help business owners understand what buyers may pay based on true earning power.

Seller’s Discretionary Earnings

SDE is the standard for small, owner-operated businesses. It starts with net income and adds back the owner’s salary, perks, and non-essential expenses to show the true amount a single owner could take home. This helps buyers compare your company to comparable businesses using an SDE multiple.

Capitalization of Earnings

This method uses a normalized earnings figure, often SDE or EBITDA, and divides it by a rate that reflects risk and expected return. It works best when earnings are stable, and the business has a consistent track record.

Discounted Cash Flow (DCF)

DCF projects future cash flow and calculates its present value using a discount rate tied to risk. It is most useful for profitable companies with predictable earnings and clear growth potential.

Income-based methods work best when the business is profitable, operates as a going concern, has a solid earnings history, and can support future forecasts with past performance.

Market-Based Methods (What Similar Businesses Sold For)

Market-based methods determine value by comparing your company to similar businesses that have recently sold, focusing on what buyers are actually paying in the current market. Professionals use comparable sales data and industry-standard multiples, such as SDE, revenue, and EBITDA, to estimate a realistic selling price, choosing the metric that best reflects how your business earns money.

These methods are popular because they’re intuitive and grounded in real transactions, giving owners a clear sense of how the market values similar businesses. The challenge is that good comps can be hard to find, especially in niche industries or small local markets, and differences in size, growth, customer concentration, or risk can make direct comparisons difficult.

Asset-Based And Liquidation Approaches

Asset-based and liquidation approaches determine value by focusing on what the business owns rather than what it earns. These methods are useful in specific situations, but they don’t always reflect the full value of your business, especially if cash flow or customer relationships drive most of the worth.

Adjusted Net Asset Value

This method works when assets are the primary source of value, which is common in property-heavy, investment, or holding companies. The valuer updates the balance sheet to reflect fair market value for equipment, inventory, property, and other assets, then subtracts liabilities to calculate the adjusted net asset figure.

Liquidation Value

Liquidation value applies when the business is no longer viable as a going concern. It estimates what the assets would sell for in a quick or forced sale, often at discounted prices. This approach is used when the business cannot continue operations and only the asset recovery matters.

How To Prepare Your Small Business For Valuation

Preparing your business valuation starts with clean financials, organized documents, and a clear explanation of how the business has grown and where it’s headed. The more clarity you provide upfront, the easier it is for a valuer to understand your numbers and produce a reliable estimate.

Clean Up Your Financials

Cleaning up your financials means giving valuers clear, accurate records that show true earnings and cash flow. Organize 3–5 years of statements, separate personal from business expenses, document add-backs, and explain any one-time anomalies so valuers can adjust numbers correctly.

Document Assets, Systems, And Intangibles

Documenting your assets and internal systems helps valuers understand what the business owns and how easily a buyer can take it over. List physical and intangible assets, note realistic values, and highlight SOPs or operating systems that reduce buyer risk.

Clarify Your Growth Story and Risks

Clarifying your growth story and risks helps valuers see where the business is going, not just its history. Summarize performance trends, offer realistic forecasts, identify key risks, and be transparent early to avoid last-minute discounts during due diligence.

Using Your Small Business Valuation To Plan A Sale

Using your small business valuation to plan a sale means turning results into a practical strategy for pricing, negotiation, and deal structure. A solid valuation helps you understand fair market value, set realistic expectations, and explain your number confidently to buyers, lenders, and advisors. It becomes the foundation for how you position your business, justify your price, and protect your interests throughout the sale process.

Turning A Valuation Report Into A Pricing Strategy

Use your valuation report to shape a clear and defensible pricing strategy. Most reports provide a value range, which you can convert into your list price, target price, and walk-away price. Referencing the valuation during negotiations helps justify your numbers to buyers, lenders, and advisors.

From Valuation to Deal Structure

Use the valuation to balance price, risk, and timing as you move toward closing. Your valuation guides how the total price will be paid, not just the dollar amount. It supports different payout options, such as cash at close, seller financing, earn-outs, or equity rollovers, and gives you leverage when negotiating terms.

Communication Habits That Prevent Surprises In Valuation

Strong communication with your broker and valuer keeps the process accurate and prevents delays. Clear expectations and consistent updates help avoid issues that could lower your value or slow buyer interest.

Set a Clear Cadence From Day One

Establish a weekly check-in to stay aligned and keep the valuation moving. A short Friday call or summary email is enough to review delivered documents, flag any issues like unclear add-backs or missing contracts, and confirm next steps and deadlines.

Use a Simple Weekly Email Structure

A simple, repeatable update format helps track progress and prevents your broker or valuer from going silent. A clear structure keeps everyone aligned and makes it easier to spot issues early.

Five-Point Weekly Update

- Valuation Status

- Is the engagement letter signed?

- Is the data room prepared and accessible?

- Any updates on valuation progress?

- Key Metrics

- Latest Seller’s SDE or EBITDA

- Current revenue run-rate

- Highlights from the sales pipeline

- Buyer/Advisor Activity

- New buyer inquiries or expressions of interest

- Outreach efforts by the broker

- Feedback from advisors or lenders

- Next Actions (Upcoming 7 Days)

- Upload tax returns

- Deliver updated financial statements

- Finalize the working-capital schedule

- Blockers or Delays

-

- Waiting on Certified Public Accountant (CPA) input

- Missing customer contracts

- Unresolved add-backs or adjustments

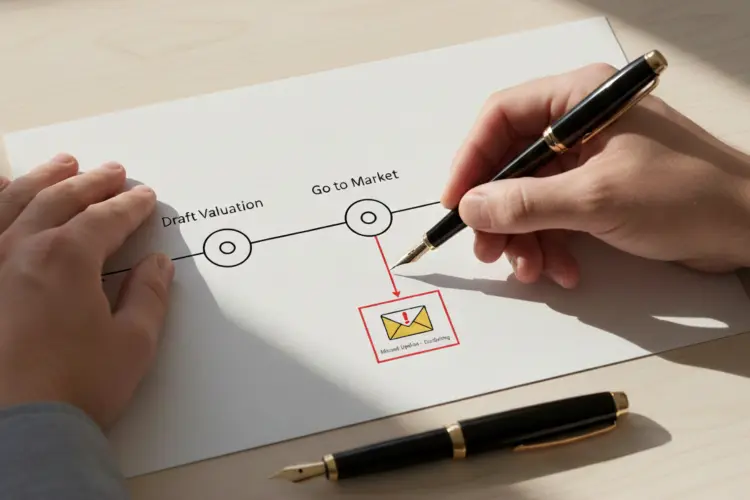

Milestone Check-Ins and Escalation Triggers

Milestone reviews keep your valuation aligned with each stage of the sale process. Schedule short check-ins when draft numbers are ready, when you’re preparing to go to market, and when serious offers arrive. If you miss an update, send a brief escalation email, such as “Status Request: Valuation/Offers as of [Date]”, to keep momentum. Consistent communication helps prevent surprises later during offer comparison, deal structuring, and due diligence.

Common Small Business Valuation Mistakes

Small business owners often lose value because of avoidable mistakes during the valuation process, not because the business itself is weak. Knowing the common pitfalls helps you set realistic expectations and enter negotiations on a stronger footing.

- Believing Only Your “Gut Number”

Personal attachment can inflate expectations, leading to overpricing, stale listings, or wasted time. An objective valuation grounds your expectations in real cash flow, risk, and market conditions. - Relying Only on Online Calculators

These tools offer rough estimates but ignore industry nuances, financial adjustments, deal structures, and risk. They’re helpful for quick checks but not for making sales decisions. - Hiding or “Smoothing” Problems

Concealing weak years or customer losses backfires during due diligence, often resulting in discounts or lost trust. Transparency with clear explanations builds credibility and protects value. - Treating Valuation as a One-Time Event

Valuing your business only when you’re ready to sell limits long-term planning. Regular updates support financing decisions, exit timing, and show how improvements affect your market value.

Use Your Valuation To Lead The Deal

A business valuation small business owners can trust is more than a price tag; it’s a planning tool, a negotiation tool, and a reality check. By understanding the main valuation methods and preparing clean financials, you reduce the risk of surprises later in the process.

Clear communication with your broker and valuation expert also keeps the sale on track. When you combine a solid valuation with disciplined weekly updates and milestone check-ins, you enter offers and deal negotiations with far more clarity and control.

Frequently Asked Questions

What is the best valuation method for a small business?

The best valuation method for a small business is usually the income-based approach using SDE or EBITDA, because it reflects true earning power and buyer expectations.

How is small business valuation different from valuing a large company?

Small business valuation focuses more on SDE, owner involvement, transferability, and risk, while large-company valuation relies on EBITDA, management depth, and broader market data.

Do I really need a professional valuation before selling my small business?

Yes, getting a professional small business valuation helps you set a realistic price, avoid overpricing, and defend your number during negotiations with buyers and lenders.

How often should a small business owner update their valuation?

Most owners should update their small business valuation every 1 to 3 years, or whenever significant financial or operational changes occur.

How does better communication with my broker and valuation expert improve my small business valuation outcome?

Clear weekly communication with your broker and valuation expert prevents missing data, reduces delays, and leads to a more accurate and defensible business valuation for a small business.

References

- DeNicola, L. (n.d.). Small business valuation methods: How to value a small business. In Entrepreneurial Management – ENTBUS 357. Boise State University. https://boisestate.pressbooks.pub/typesofent/chapter/small-business-valuation-methods-how-to-value-a-small-business/

- Harvard Business School Online. (2017, April 21). How to value a company: 6 methods and examples. HBS Online. https://online.hbs.edu/blog/post/how-to-value-a-company/

- Köseoğlu, S. D., & Almeany, S. S. A. (2020). Introduction to business valuation. In S. D. Köseoğlu (Ed.), Valuation Challenges and Solutions in Contemporary Businesses (pp. 1–23). IGI Global. https://doi.org/10.4018/978-1-7998-1086-5.ch001

- Kenton, W. (2021, February 28). Adjusted net asset method: Definition and uses in valuation. Investopedia. https://www.investopedia.com/terms/a/adjusted-net-asset-method.asp

- Moore, A. D. (2011, March 8; rev. 2022, August 18). Intellectual property. In E. N. Zalta (Ed.), The Stanford Encyclopedia of Philosophy. https://plato.stanford.edu/entries/intellectual-property/

- Program on Negotiation at Harvard Law School. (2025, August 5). How to negotiate a business deal. https://www.pon.harvard.edu/daily/business-negotiations/how-to-negotiate-a-business-deal/