Choosing the right SMB broker can determine if your business sale leads to a smooth transaction or unexpected setbacks. Business owners who have narrowed their options to two experienced brokers often struggle to decide who is best equipped to handle complex transactions, qualified buyers, and the due diligence process.

Evaluation scorecards, interviews, and red flag checks may already reveal strengths and weaknesses, but a clear final decision method is still needed. This article explains how SMB owners can compare top brokers with confidence by using data-driven tools and expert advice to achieve a successful sale.

Step 1 – Start by Comparing Your Broker Scorecards

The fastest way to choose between two top candidates is to analyze your broker scorecards side by side. This process helps business owners identify clear differences in deal structuring, marketing packages, and track record. Comparing performance data ensures more informed decisions, which is essential for business sales and complex business transactions where small businesses can’t afford costly mistakes.

Broker scorecards, like those in Section VI’s plug-and-play toolkit, reveal which business broker has the strongest mix of industry expertise, financial analysis skills, and access to qualified buyers. They also highlight which broker’s services and approach to acquisitions align better with your business goals. Many brokers claim they can deliver a smooth transaction, but the scorecard can help identify which broker is better positioned for a successful sale.

Look for a 2-Point Difference as a Clear Signal

A 2-point difference on your scoring grid is often enough to pick the right broker. This gap suggests one candidate has superior industry knowledge, better access to prospective buyers, or a more effective marketing package. A broker who scores higher on communication, business valuation accuracy, and deal execution often shows better potential to meet market expectations.

Understand What Each Score Reflects in Performance

Every score on the grid represents real-world performance, from the quality of past clients’ experiences to how each broker handled complex transactions. A strong score in market reach or financial analysis signals the broker’s ability to connect with potential buyers and negotiate higher sale prices. Business owners reviewing these metrics can see who demonstrates ethical standards and a proven process for achieving a successful transaction.

Why Small Score Gaps Require a Deeper Look

If both brokers are close in total points, review qualitative factors such as communication style, exit planning strategies, and how they manage due diligence. Small score gaps often mean both candidates are competent, but one may provide more valuable insights or stronger buyer networks supported by organizations like the International Business Brokers Association. Look beyond numbers to determine who can handle financing arrangements, specialized services, and the unique needs of your business more effectively.

Step 2 – Go Beyond Numbers with Interview Insights

Numbers reveal trends, but interviews show how a broker will manage your business sales process when challenges arise. Evaluating interview responses helps business owners confirm which candidate understands their business needs and can adapt to the demands of lower middle market transactions.

These insights often reveal who has the right mix of industry expertise, connections to prospective buyers, and practical solutions for a successful sale..

Review How Each Broker Communicated

Clear and empathetic communication is often linked to stronger performance in professional interactions. An experienced business broker should not only provide transparent explanations of services, realistic timelines, and structured updates but also demonstrate the ability to understand and respond to a client’s perspective.

Research on empathy competence in professional communication highlights that professionals who actively listen, use perspective-taking, and adapt their responses tend to build better trust and rapport. This approach is particularly important when discussing business valuation, commission structures, and marketing packages, as brokers who communicate with empathy are better equipped to handle complex business transactions and client concerns.

Who Showed Real Understanding of Your Goals?

The right broker will actively listen to your business goals and exit planning objectives. Pay attention to which broker suggests strategies like targeting qualified buyers, leveraging SBA loans, or crafting a tailored marketing package for acquisitions. Brokers with deep industry expertise often provide valuable insights into pricing strategies and business opportunities that directly improve outcomes.

Spot Nonverbal Clues from Your Conversations

Nonverbal cues, such as tone, pacing, and body language, can be as critical as verbal responses when evaluating a business broker. Observing these visual and behavioral signals helps SMB owners assess how a broker might manage complex business transactions and interactions with prospective buyers.

Research suggests that access to nonverbal signals plays a role in building mutual trust and detecting honesty, which can reveal strengths or potential red flags that may not surface through scorecards or formal evaluations.

- Steady tone and clear communication: A broker who maintains a calm, confident tone often demonstrates experience in handling business sales and negotiations.

- Active listening and responsiveness: Careful listening and thoughtful responses can indicate an understanding of your business needs and goals.

- Positive body language and engagement: Maintaining eye contact and leaning slightly forward can signal genuine interest in your small business and its value.

- Consistent pacing and focus: A broker who avoids rushing or rambling shows professionalism and control during the selling process.

- Openness to questions: A broker who welcomes key questions about services or acquisitions demonstrates transparency and confidence in their approach.

Step 3 – Ask a Strategic Tie-Breaker Question

When two brokers seem equally capable, a well-placed tie-breaker question can uncover who is better prepared to deliver results. Asking a real-world scenario question tests problem-solving, industry knowledge, and how they structure deals for small businesses.

This step helps business owners confirm who can manage due diligence, navigate buyer negotiations, and meet business needs with precision.

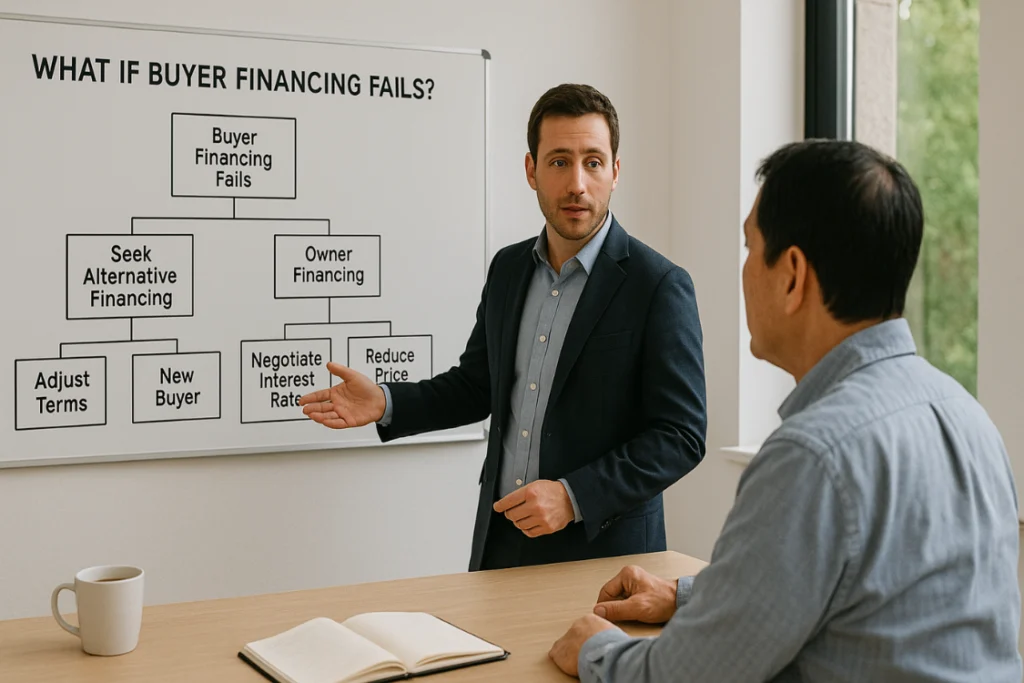

Use a Real-World Scenario to Gauge Problem-Solving

Ask each broker how they would handle a stalled negotiation or a buyer requesting unusual financing arrangements. Their answers reveal how they approach the transaction process and whether they can deliver higher sale prices. A good broker will explain their strategy for managing potential buyers while protecting your business value.

What a Strong Answer Should Include

Look for responses that reference financial analysis, thorough due diligence, and specific marketing strategies. The best brokers will detail how they qualify prospective buyers, customize a marketing package, and use anonymized data to maintain confidentiality. These answers help indicate which broker may be better equipped to handle the sale efficiently and minimize delays.

Red Flags to Watch for in Their Responses

Paying attention to how a business broker answers tough questions can reveal potential red flags. SMB owners should watch for signs of weak business brokerage skills, lack of industry expertise, or gaps in handling business transactions and business sales. A right broker will offer transparent, data-driven strategies that align with your small business goals and services.

- Avoiding specific details: Brokers who cannot explain their track record or past clients’ outcomes may lack experience in acquisitions or the selling process.

- Unrealistic promises about price: Claiming guaranteed higher sale prices without thorough due diligence or financial analysis is a warning sign.

- Vague answers about services: A good broker should clearly outline their marketing package, deal structuring approach, and business valuation methods.

- Inability to explain business opportunities: Limited insight into prospective buyers or market trends may indicate weak industry knowledge.

- Lack of transparency about costs: Brokers who hesitate to discuss commission structures, additional costs, or transaction process steps could create problems later.

Trust Your Gut but Back It with Data

Final decisions often come down to trust and confidence. While instincts matter, pairing them with scorecard data and interview insights ensures SMB owners choose the right business broker.

This balanced approach reduces risk and improves outcomes for complex transactions, especially when working toward higher sale prices and a smooth transaction.

Why Emotional Intelligence Matters in Broker Choice

Emotional intelligence influences how decisions are made under pressure, particularly in complex business negotiations. An experienced business broker with strong emotional intelligence can better recognize and regulate emotions, which helps them manage stress, adapt during negotiations, and reduce the impact of cognitive biases.

Research on decision-making suggests that emotional intelligence can improve judgment by minimizing errors and fostering a balanced view of risks and opportunities. This ability to interpret situations with clarity can build trust with buyers and clients, which often supports smoother transactions and better collaboration. For SMB deals that involve sensitive information or multiple decision-makers, a broker who demonstrates emotional intelligence is better positioned to make sound, well-informed choices.

Finding the Right Balance Between Logic and Instinct

Use the data from your broker evaluation (scorecards, interviews, and due diligence process) while trusting your observations. A right broker is not just the one with the highest scores but the one who aligns with your business goals, values, and communication style. This balance ensures informed decisions that support your long-term success.

Signs You’ve Found a Broker You Can Rely On

Finding the right business broker means identifying someone who can deliver expert advice, handle business acquisitions, and manage business sales with professionalism. SMB owners should look for signs that the broker has the skills, services, and track record needed for a smooth transaction and successful sale.

- Proven track record of success: A reliable broker can show past business transactions, client testimonials, and results from small businesses similar to yours.

- Clear and transparent services: They explain commission structures, costs, and the entire sale process without hesitation.

- Strong industry expertise: A good broker demonstrates knowledge of market trends, business valuation methods, and strategies for attracting qualified buyers.

- Effective deal structuring: They know how to handle financing arrangements, acquisitions, and complex transactions to achieve higher sale prices.

- Valuable insights and guidance: A right broker provides actionable advice during due diligence and exit planning, ensuring your business goals are met.

Make a Confident Choice Between Two Qualified Brokers

Choosing the right SMB broker means combining insights from scorecards, interviews, and due diligence with your instincts. A business broker who communicates clearly, understands your business goals, and adapts to challenges is more likely to deliver a smooth transaction and better results.

Pay attention to track record, industry expertise, and how effectively each broker engages with qualified buyers to ensure a successful sale. Once you are confident in your choice, finalize the agreement and begin the selling process with a strong foundation.

Frequently Asked Questions

How do I break a tie between two equally qualified business brokers?

Compare broker scorecards, review interview insights, and use a real-world scenario question to see who can better handle the selling process and qualified buyers.

What should I ask brokers to see how they handle tough situations?

Ask about deal structuring, financing arrangements, and how they manage potential buyers during complex transactions to evaluate their problem-solving skills.

Does it matter if one broker has slightly better client reviews?

Yes, client reviews reveal past clients’ experiences and can signal which business broker has a stronger track record of successful transactions and higher sale prices.

How much weight should I give to my gut feeling in this decision?

Trust your instincts but pair them with data from scorecards and due diligence to make informed decisions that align with your business goals.

What’s the biggest mistake people make when choosing between top brokers?

Many SMB owners focus only on price or commission structures instead of evaluating industry expertise, communication skills, and the broker’s ability to deliver a smooth transaction.

References

- Chen, C., Ishfaq, M., Ashraf, F., Sarfaraz, A., & Wang, K. (2022). Mediating role of optimism bias and risk perception between emotional intelligence and decision-making: A serial mediation model. Frontiers in Psychology, 13, 914649. https://doi.org/10.3389/fpsyg.2022.914649

- Fuller, M., Kamans, E., & de Jong, M. D. T. (2021). Conceptualizing empathy competence: A professional communication perspective. Management Communication Quarterly, 35(3), 396–424. https://doi.org/10.1177/10506519211001125

- Kazemitabar, M., Mirzapour, H., Akhshi, M., Vatankhah, M., Hatami, J., & Doleck, T. (2022). Power of nonverbal behavior in online business negotiations: Understanding trust, honesty, satisfaction, and beyond. Interactive Learning Environments, 30(8), 1442–1459. https://doi.org/10.1080/10494820.2022.2121728