Choosing the wrong broker can cost you time, money, and momentum. Reference calls are one of the few chances to hear how a broker actually performed during a transaction, not just what they promised upfront. But without a clear system, such as a broker evaluation scorecard, to track those insights, important details can get lost or misjudged.

A broker evaluation scorecard helps turn that feedback into clear, comparable numbers. It allows your team to rank broker-dealers across key areas like responsiveness, execution, and client satisfaction.

This article walks you through how to build and use a scorecard, choose the right metrics, assign fair scores, and compare results across firms to find the strongest advocate for your business sale

What is a Broker Evaluation Scorecard?

A broker evaluation scorecard is a simple way to organize and compare reference responses during the selection process. It helps you track key feedback across different broker-dealers using clear categories and numbers instead of relying on vague impressions. This approach brings structure to a process that often relies too heavily on memory or informal notes.

Creating your own scorecard allows you to move faster, ask better questions, and rank firms based on real performance, not polished sales pitches. It also helps you account for year-specific results, especially when references mention recent transactions or changes in broker behavior.

Simple spreadsheet for tracking reference insights

The easiest format for your scorecard is a basic spreadsheet. List each broker’s name along with notes from their references: what the reference shared, how they felt about the transaction, and how strong their recommendation was. Then, assign scores for key areas so you can see patterns across responses. Include the year of each deal mentioned and link it to the reference’s account type when possible.

This structure helps your organization spot differences in communication, execution, and buyer results. With everything in one place, you can better understand each broker’s track record and long-term success.

Categories to include: responsiveness, marketing, recommendation

Focus on reference feedback that reflects actual outcomes. Important areas to score include how responsive the broker was during the deal, the quality of their marketing and buyer outreach, and whether the reference would recommend them again.

Each of these roles affects how a broker-dealer handles your future transactions. Including account type and deal year in your notes adds context that helps your team assess which successes are most relevant to your situation. Using a fixed set of categories ensures you compare all brokers on the same scale.

Choosing the Right Scoring Metrics

Scoring brokers fairly means choosing the right metrics that actually matter to the outcome. A strong broker-dealer scorecard reflects not just what was promised, but what was delivered.

Good metrics reveal how brokers show up in real-world deals. These numbers help you rank and filter candidates based on priorities.

Responsiveness: timely and clear communication

Speed and clarity during a deal can make or break your confidence in a broker. Ask references how quickly the broker responded to updates, questions, or issues.

Late replies, vague updates, or missed calls often point to deeper issues with organization and accountability. These signals should impact how you score their responsiveness.

Marketing & buyer outreach: quality and reach

Marketing is more than just posting a listing. It’s about how well a broker can act as a connector—translating business needs, channeling scarce buyer attention, and mediating between your goals and market dynamics. Ask references how effectively the broker attracted qualified buyers, tailored the messaging, and leveraged their network to build interest.

Score this area based on the quality of outreach, not just the number of views or clicks. Brokers with broader reach and strong mediation skills often build trust across business types and close deals with better terms and less friction. These qualities reflect how brokers operate across social and organizational boundaries, helping local businesses access broader markets and buyers.

Overall recommendation: yes/no plus reasons

The overall recommendation is one of the most important data points in your broker evaluation scorecard. A clear yes or no from each reference provides a direct view of the broker’s impact on the transaction and client relationship.

Here’s how to make the most of this question:

- Ask for a direct yes or no. This keeps the feedback simple and easy to track across broker-dealers.

- Capture the reason behind their answer. Add a notes section on your scorecard to share what drove their response.

- Look for specific examples. A strong advocate often points to clear actions like fast execution or buyer follow‑through.

- Watch for vague praise. Generic comments like “they were great” may hide weak areas that require follow-up.

- Record language that shows confidence or hesitation. Tone matters just as much as the words, especially when evaluating firms that appear similar on paper.

This type of feedback adds depth to your numbers and helps confirm which brokers truly earned their score.

Assigning Scores Effectively

Assigning fair scores means using a simple scale, weighting what matters, and staying consistent, even when comments vary. A clear scorecard turns reference feedback into a reliable overview of how each broker-dealer performs across key areas.

Each broker should be scored using the same method so you can sum and compare without bias. This structure helps your organization avoid confusion and base decisions on solid, comparable data.

Scale recommendations (e.g., 1–5 or yes/no)

Use a clear scoring system, like 1 to 5, or a yes/no, when measuring specific questions. Keep the scale consistent across brokers so your final table makes sense.

Avoid using too many rating types or switching formats halfway through. The goal is to keep your scorecard easy to review and update.

Weighting key metrics based on priorities

Some areas are more important than others, depending on your deal type or organization’s needs. You can assign weights to each metric to reflect those priorities.

For example, responsiveness might carry more weight if timing is critical to your success this year. Adjusting weights helps the scorecard reflect real business goals.

Handling qualitative comments objectively

Not all feedback fits into a number. Still, it’s important to track what references share—both the good and the bad.

To avoid bias, note the comments in context, then use them to adjust scores only if they clearly align with your chosen metrics. That way, your scorecard stays based on structured data, not gut feeling.

Comparing Scorecards Across Brokers

Comparing scorecards helps you move from raw reference data to clear patterns. It also gives your team a shared view of how each broker-dealer stacks up.

Once the scores are entered, you’ll start to see trends emerge across roles and firms.

Summarizing total scores and metric averages

Use a total score column to quickly see who stands out. Then look at metric averages to spot strengths and weak points.

For example, a broker may score high in client satisfaction but low in marketing execution. That split helps you ask sharper follow-up questions.

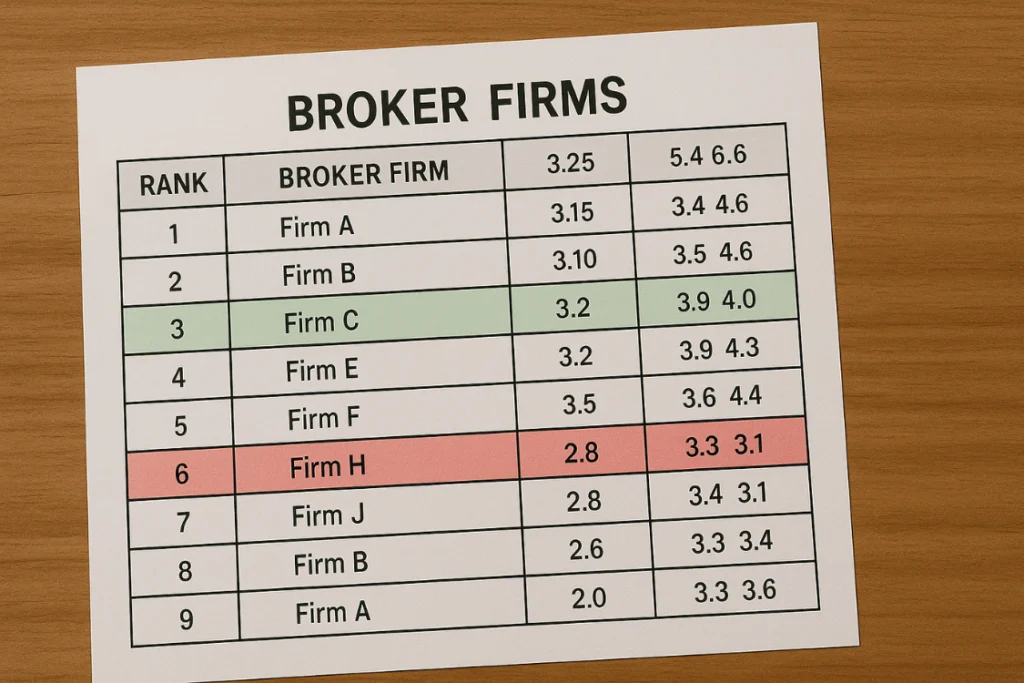

Visual comparison: tables, charts, or color‑coding

Turning your broker evaluation scorecard into a visual format makes it easier to spot trends, compare firms, and explain your rankings to others. Simple tools like tables or charts help summarize large amounts of data quickly.

Here are some visual methods to consider:

- Use a color-coded table. Green can highlight high scores, yellow for average, and red for weak performance across broker-dealers.

- Create a bar chart for each metric. This lets you see how each broker ranks in specific areas like execution or client satisfaction.

- Build a heatmap to show score patterns. A heatmap helps your organization find strong or weak categories at a glance.

- Include score averages below each table. This makes it easier to summarize and compare overall performance.

- Highlight top scores with icons or bold formatting. Small design cues help teams focus on what matters during internal discussions.

These visual tools save time and make your broker-dealer scorecard easier to review and share.

Identifying top performers vs. weak areas

After you rank broker-dealers using your broker evaluation scorecard, patterns begin to surface. Use the data to compare firms side by side and find which ones consistently show strong performance and which ones raise concerns.

Here are a few ways to identify top performers versus weak areas:

- Look for high scores across all metrics. Brokers who perform well in responsiveness, execution, and client satisfaction are often reliable choices.

- Spot low numbers in key categories. Weak scores in marketing or communication can signal trouble in the transaction process.

- Compare averages, not just totals. A high total score might hide weak performance in important roles if not viewed by category.

- Track how often concerns repeat. If multiple references raise the same issue, it’s likely not a one-time problem.

- Check for standout metrics. A firm might score average overall but excel in one area that matters most to your organization.

These insights help you decide which firms to move forward with and which to remove from your list.

What to Do with Mixed or Incomplete Data

Some references don’t give full answers. Others might say great things in one area and bad things in another. Mixed data isn’t useless; it just takes extra thought.

Instead of throwing out unclear responses, use structure to guide your next steps.

Spotting inconsistencies in feedback

If one reference praises a broker’s communication but another flags it as weak, that’s not just a red flag; it’s an opportunity. Add a note to your broker evaluation scorecard and mark the inconsistency clearly.

While a single off-score might be noise, consistent contradictions across references call for deeper review. Inconsistent feedback doesn’t always mean poor performance; it may signal the need for clarification. Asking follow-up questions or seeking additional references helps you understand which parts of the broker’s strategy truly worked in past transactions.

This type of effort can lead to better insight and improved decision-making, especially when inconsistent feedback triggers deeper learning and clarification.

Seeking additional references or follow-up questions

If feedback feels incomplete, ask the broker for more references. Use your scorecard to list the missing data and choose new questions based on the gaps.

This helps you stay focused and avoid re-asking the same things. Each new call should help you close the loop.

Making judgment calls with limited information

In some cases, you’ll have to score based on the data you have. Make a note in your spreadsheet and share with your team why certain numbers were chosen.

Transparency helps your organization trust the process, even when the numbers aren’t perfect.

Using Scorecard Insights for Final Decisions

The scorecard isn’t the final answer, but it helps you choose with clarity. Use the numbers, patterns, and feedback to rank your finalists and move into final interviews.

A structured review gives you confidence and keeps bias out of the process.

Ranking brokers and selecting finalists

Use your total score and top categories to build a shortlist. The top two or three firms should be easy to identify once all data is filled in.

At this point, each number represents a real insight, not just a gut feeling.

Combining quantitative scores with qualitative patterns

Look beyond the numbers for strong patterns in the comments. For instance, if multiple references use the same language to describe the broker’s follow-through or execution, take that seriously.

This combination gives a fuller view of how the broker performs in real transactions.

Taking your scorecard into a final interview round

Bring the scorecard with you to the final broker interview. Use it to ask follow-up questions, confirm data, and address weak areas.

It becomes both a filter and a guide, helping you choose the right advocate to close your deal.

Turn Broker Reference Feedback into a Confident Decision

A broker evaluation scorecard helps take the guesswork out of choosing the right partner. Rather than relying on scattered notes or gut instincts, you can score each broker across clear metrics, track patterns, and rank firms based on real data.

Customize your scorecard to match your priorities, deal size, and the type of organization you run. Once your data is in place, use those insights to narrow your list and bring top candidates into the final interview round.

A clear process leads to stronger decisions and better outcomes.

Frequently Asked Questions

What scoring scale works best for broker evaluations?

A 1–5 scale is the most effective for broker evaluation scorecards because it allows for quick comparisons and consistent tracking.

How many references are enough to score reliably?

Three to five references per broker-dealer usually provide enough data to rank performance and spot consistent patterns.

Should I weigh certain categories more?

Yes, you can weight important areas like responsiveness or marketing higher based on your transaction goals and deal type.

Can I adjust the scorecard during the process?

You can update your broker-dealer scorecard as needed, especially if new metrics or deal factors become more important.

What if two brokers have identical scores?

If two brokers rank equally, use qualitative feedback and reference comments to break the tie and guide your final decision.

References

- Bräuchler, B., Knodel, K., & Röschenthaler, U. (2021). Brokerage from within: A conceptual framework. International Sociology, 33(4). https://doi.org/10.1177/09213740211011202

- Chambers, C. R., Alves, M., & Aceves, P. (2024). Learning from inconsistent performance feedback. Organization Science. https://doi.org/10.1287/orsc.2022.16833